CONTACTAbout UsCAREER OPPORTUNITIESADVERTISE WITH USPRIVACY POLICYPRIVACY PREFERENCESTERMS OF USELEGAL NOTICE

© 2026 Equal Entertainment LLC.

All Rights reserved

All Rights reserved

By continuing to use our site, you agree to our Privacy Policy and Terms of Use.

We need your help

Your support makes The Advocate's original LGBTQ+ reporting possible. Become a member today to help us continue this work.

Your support makes The Advocate's original LGBTQ+ reporting possible. Become a member today to help us continue this work.

Anticipation around the Supreme Court's recent ruling on the Defense of Marriage Act has spurred LGBT couples to take a serious look at their financial planning needs. Even with the Court's decision, a majority of states still have either limited or no recognition of same-sex marriages. This leads to a "patchwork" approach to equality, where each state can determine the rights of LGBT couples under that state's laws. It also raises more questions and requires more guidance.

Here are some important areas to consider if you are beginning this process. This is not an exhaustive list -- it is a starting point:

Find the Right Advisor: seek out advisors, attorneys and other professionals who fully understand the unique planning needs of LGBT couples.

Healthcare Decisions: consider executing a healthcare proxy and a directive to physicians or a living will to designate an agent (e.g. your partner) to make medical decisions on your behalf and to outline your specific wishes with regard to critical end-of-life decisions.

Execute a Will: be specific in making your wishes known. Lacking a will, the identity of your heirs is determined by the law, not by you. A will and/or trust specifying your intentions can help transfer your assets to your partner if that is your choice.

Consider a Durable Power of Attorney: a power of attorney provides one person the financial authority to act and sign on behalf of another, and therefore can be used to authorize your partner to make financial or business decisions for you if you become incapacitated.

This only scratches the surface, it's critical for LGBT couples to think through the complexities of financial planning in the midst of an evolving legal framework. Continue to educate yourselves, have important conversations with each other, and surround yourselves with professionals to help guide you through these fast-changing times.

Wells Fargo & Company and its affiliates do not provide legal advice. Please consult your legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared.

From our Sponsors

Most Popular

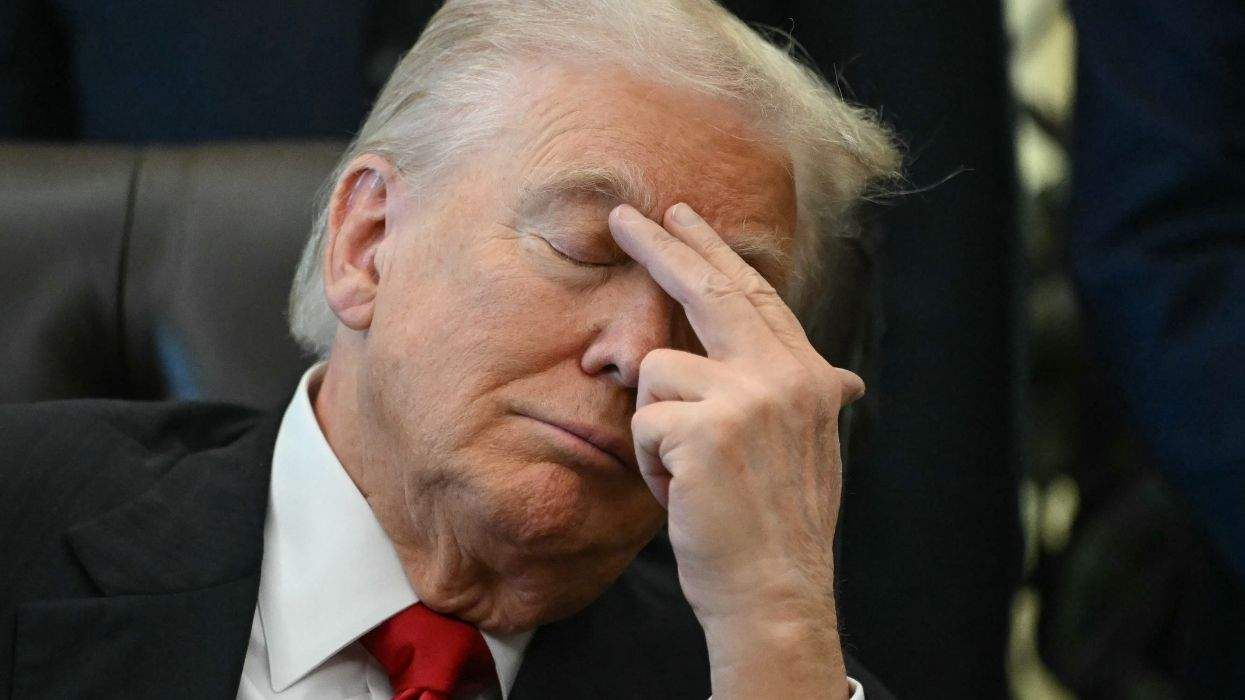

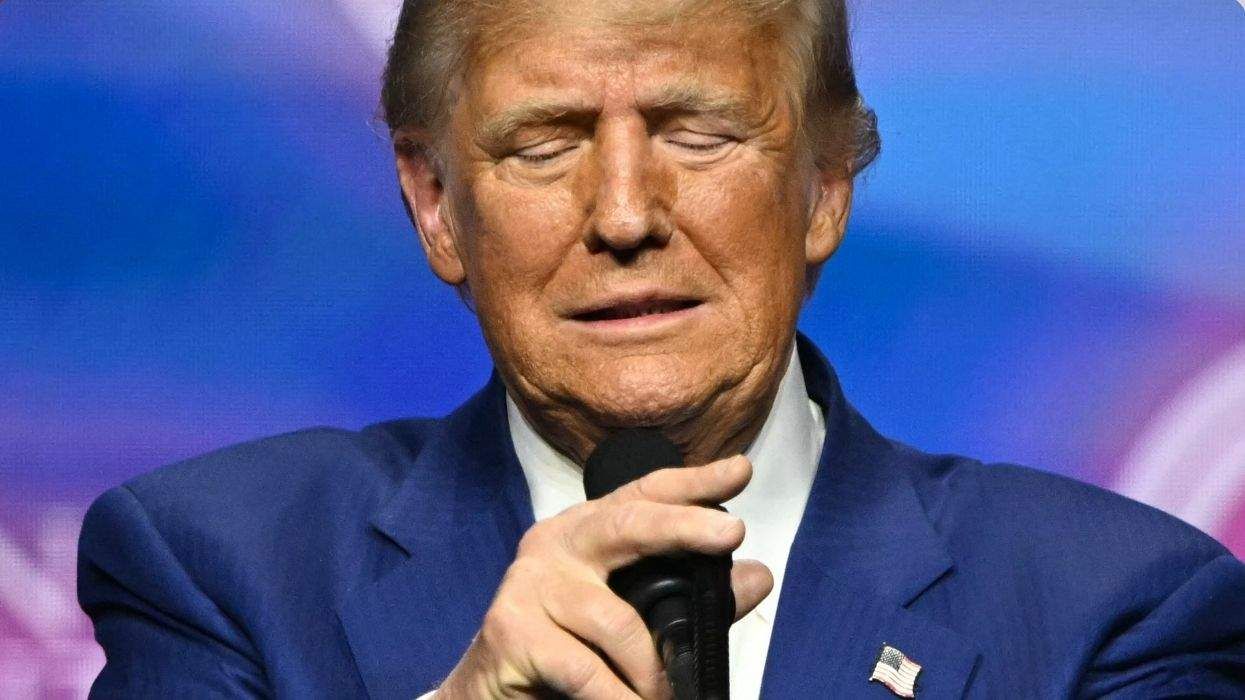

Bizarre Epstein files reference to Trump, Putin, and oral sex with ‘Bubba’ draws scrutiny in Congress

November 14 2025 4:08 PM

True

Jeffrey Epstein’s brother says the ‘Bubba’ mentioned in Trump oral sex email is not Bill Clinton

November 16 2025 9:15 AM

True

Watch Now: Pride Today

Latest Stories

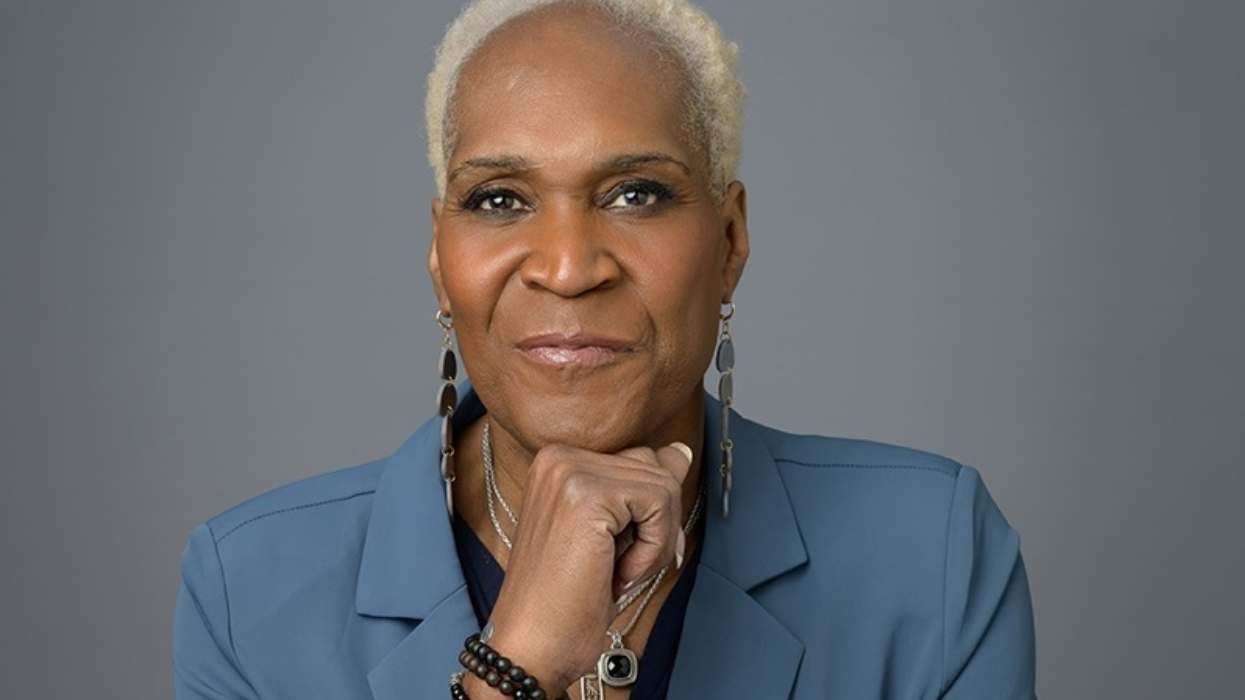

As groundbreaking trans politician Andrea Jenkins retires, a look at her life and career

December 31 2025 5:49 PM

9 queer celebrities who made us proud in 2025

December 31 2025 4:35 PM

9 viral queer moments of 2025: From Nicki's right turn, to the 'Funeral Stud'

December 31 2025 4:30 PM

Kellyanne Conway says Trump critics need a husband — including lesbian Rosie O'Donnell

December 31 2025 2:54 PM

San Francisco green-lights affordable housing for LGBTQ+ seniors

December 31 2025 11:45 AM

If 2025 tested our resolve, 2026 will prove our resilience

December 31 2025 7:00 AM

Kazakhstan bans so-called LGBTQ+ propaganda

December 30 2025 3:24 PM

Trump administration bans abortions through Department of Veterans Affairs

December 30 2025 11:07 AM

Zohran Mamdani: Save a horse, play a yet-unreleased Kim Petras album

December 30 2025 10:29 AM

How No Kings aims to build 'protest muscle' for the long term

December 30 2025 7:00 AM

Missing Black trans man Danny Siplin found dead in Rochester, New York

December 29 2025 8:45 PM

'Heated Rivalry' season 2: every steamy & romantic moment from the book we can't wait to see

December 29 2025 5:27 PM

Chappell Roan apologizes for praising late Brigitte Bardot: 'very disappointing'

December 29 2025 4:30 PM

RFK Jr.'s HHS investigates Seattle Children's Hospital over youth gender-affirming care

December 29 2025 1:00 PM

Zohran Mamdani claps back after Elon Musk attacks out lesbian FDNY commissioner appointee

December 29 2025 11:42 AM

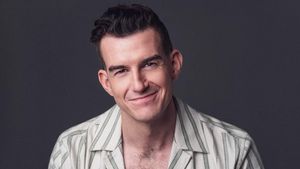

Trump's gay Kennedy Center president demands $1M from performer who canceled Christmas Eve show

December 29 2025 10:09 AM

What does 2026 have in store for queer folks? Here’s what's written in the stars

December 29 2025 9:00 AM

In 2025, being trans in America means living under conditional citizenship

December 29 2025 6:00 AM

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes