Without knowing anything about your situation, I can't tell if right now is the perfect time to buy a piece of real estate. But I can offer a few tips to help make sound financial decisions that ensures you don't feel trapped in a house you can't truly afford.

Indulge me in a brief overview of what I call, "Boot Camp for Smart Homebuyers." Regardless of your income, savings or savings habits, everyone considering buying a place should consider these next few steps.

First, get an idea of what a house or condo where you would like to live would cost. Search sites like ziprealty.com by location to get a feel for what the ideal place will cost. Do you want to live in the Gayborhood? Because that's likely to be more expensive. How much space do you need? How many bedrooms and bathrooms would you need (or want)? All of that adds up.

For some mortgages, a 20% down payment might be required. A buyer can easily spend another 6% on closing costs, plus there are other expenses that come with moving.

Before moving any further, answer a few questions, and be honest with yourself:

- "How is my credit?"

- "Do I have a reliable income?"

- "Where is the down payment going to come from?"

- "What am I willing to give up to make my mortgage payment?"

As a simple rule of thumb, payment on your home/rental/house should be around 25% or less of your income. Use sites like mortgagecalculator.com to estimate what your payment would be. Although you may qualify for a loan at 50% of your income or even higher, can you really afford that? It's unlikely.

To get a rough but useful calculation of expenses, enter purchase price, take off the down payment, while estimating the property taxes. You may be surprised by the cost of what you want to buy.

If you're pre-approved, then that gives an idea of the size of loan you may qualify for. The next step is to figure out the difference between what the mortgage payment costs (plus home-owners association, home insurance, property taxes) and what you are paying on your current home. You should consider saving the difference between your current payment and new payment for at least six months to help decide if you can adequately cover the new higher housing expenses.

If you are having trouble doing this, what are you willing to give up to make the new mortgage payments? Are you willing to cut back on travel? Going out? Dinners with friends? Is this too much to give up? If so, you may need to find a cheaper property, or save for a larger down payment.

Beyond the down payment, you should have six to nine months of payments in reserves. Life happens and closing on real estate, and moving are expensive. I rarely see someone move into a new property and not have to "update, change, fix" something, no matter how nice the property. Remember, when you own a property you are responsible for the fixes. You also may get sticker shock if moving from a rental to a house, which may have an inflated electric bill, as well as new bills for water and waste services, for example.

Beyond the down payment, you should have six to nine months of payments in reserves. Life happens and closing on real estate, and moving are expensive. I rarely see someone move into a new property and not have to "update, change, fix" something, no matter how nice the property. Remember, when you own a property you are responsible for the fixes. You also may get sticker shock if moving from a rental to a house, which may have an inflated electric bill, as well as new bills for water and waste services, for example.

While I will admit these steps aren't as exciting as running out and buying a property right away. They can help avoid some of the pitfalls home buyers succumbed to during the recent housing crisis.

Ensuring you can afford the payments, have money to pay for repairs, and weather fluctuations in housing prices, will help you avoid falling behind on other bills. Some unprepared homeowners ended up in short-sales, or foreclosures during the past few years. Not to mention those who racked up credit card debt levels that continue to spiral.

As a final parting gift, maybe there's a nice tax deduction in your future for mortgage interest and property taxes, and that could help make a dream home closer to becoming real in your budget

DAVID RAE, CFP(r) is a retirement planning specialist with Trilogy Financial Services, specializing in the needs of the LGBT community. Follow him on Twitter @davidraecfp or via his website, www.davidraefp.com.

Securities and advisory services offered through National Planning Corporation (NPC), Member FINRA,SIPC, a Registered Investment Advisor. Trilogy and NPC are separate and unrelated entities.

Beyond the down payment, you should have six to nine months of payments in reserves. Life happens and closing on real estate, and moving are expensive. I rarely see someone move into a new property and not have to "update, change, fix" something, no matter how nice the property. Remember, when you own a property you are responsible for the fixes. You also may get sticker shock if moving from a rental to a house, which may have an inflated electric bill, as well as new bills for water and waste services, for example.

Beyond the down payment, you should have six to nine months of payments in reserves. Life happens and closing on real estate, and moving are expensive. I rarely see someone move into a new property and not have to "update, change, fix" something, no matter how nice the property. Remember, when you own a property you are responsible for the fixes. You also may get sticker shock if moving from a rental to a house, which may have an inflated electric bill, as well as new bills for water and waste services, for example.

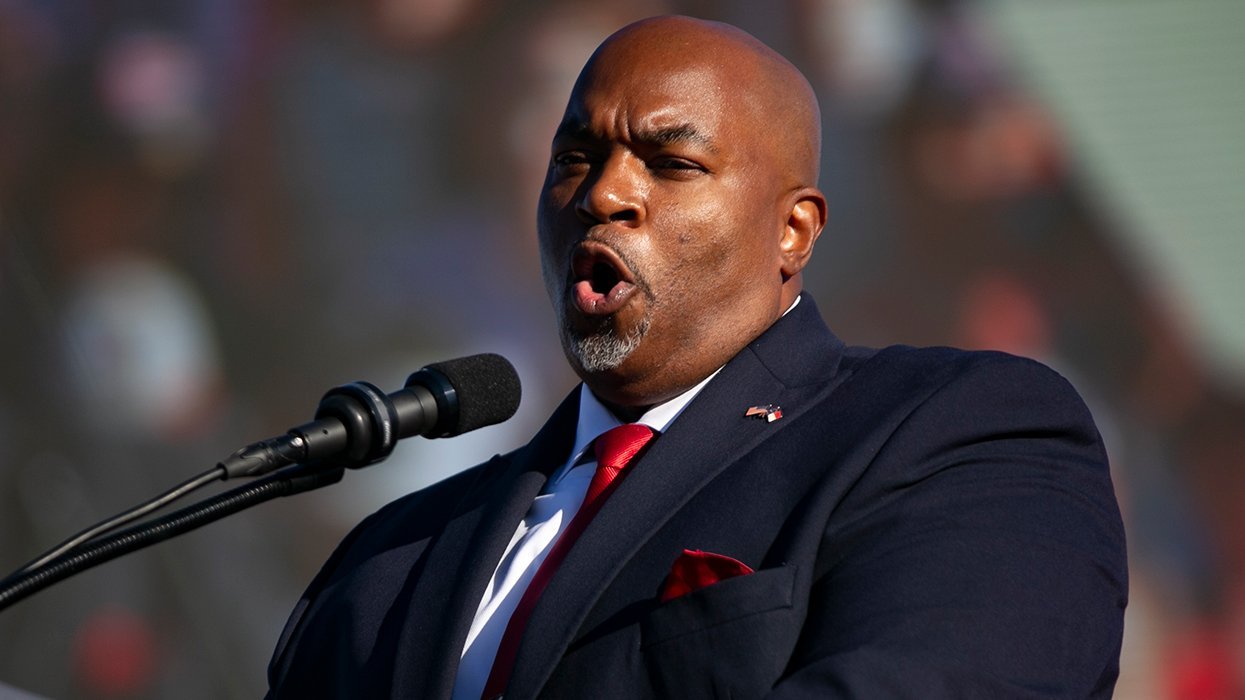

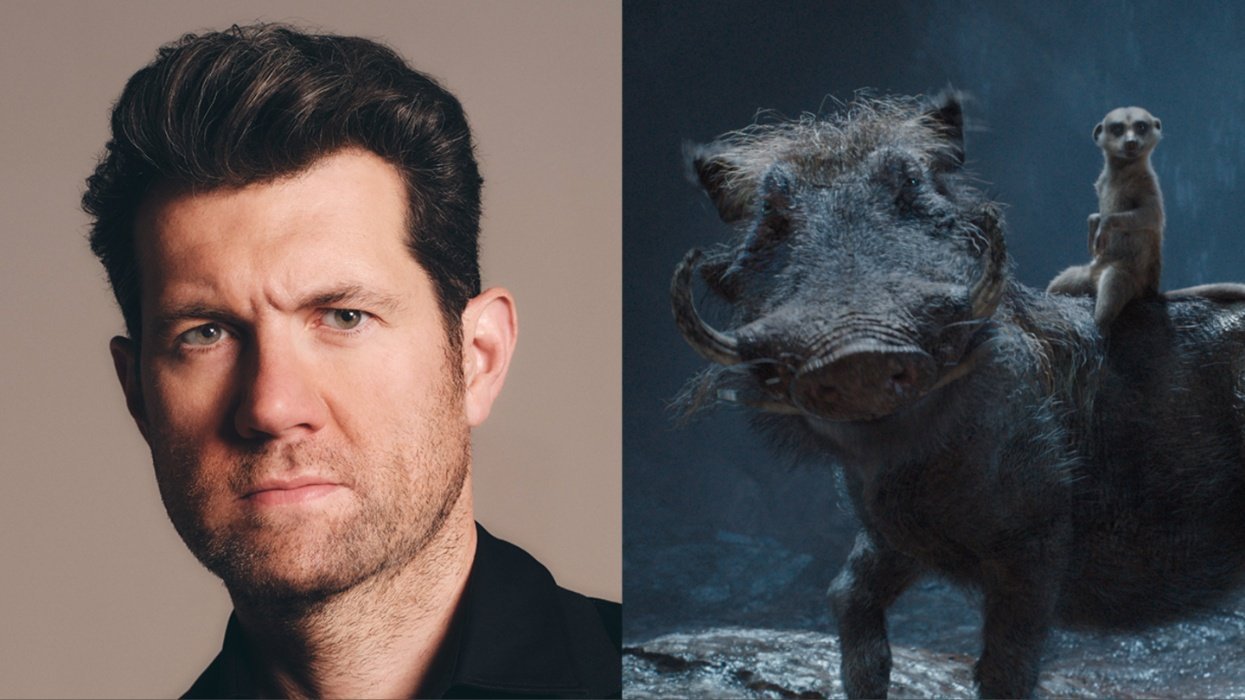

Viral post saying Republicans 'have two daddies now' has MAGA hot and bothered