All Rights reserved

By continuing to use our site, you agree to our Private Policy and Terms of Use.

Experiencing car repos, evictions, and foreclosures, the women on The Real Housewives of Atlanta are showing viewers that looking fabulous does not mean you're actually wealthy. Would you rather look like a million bucks or actually have a million bucks? Trying to fake it till you make it could put you on the road to financial ruin, or just maybe even just being flat broke.

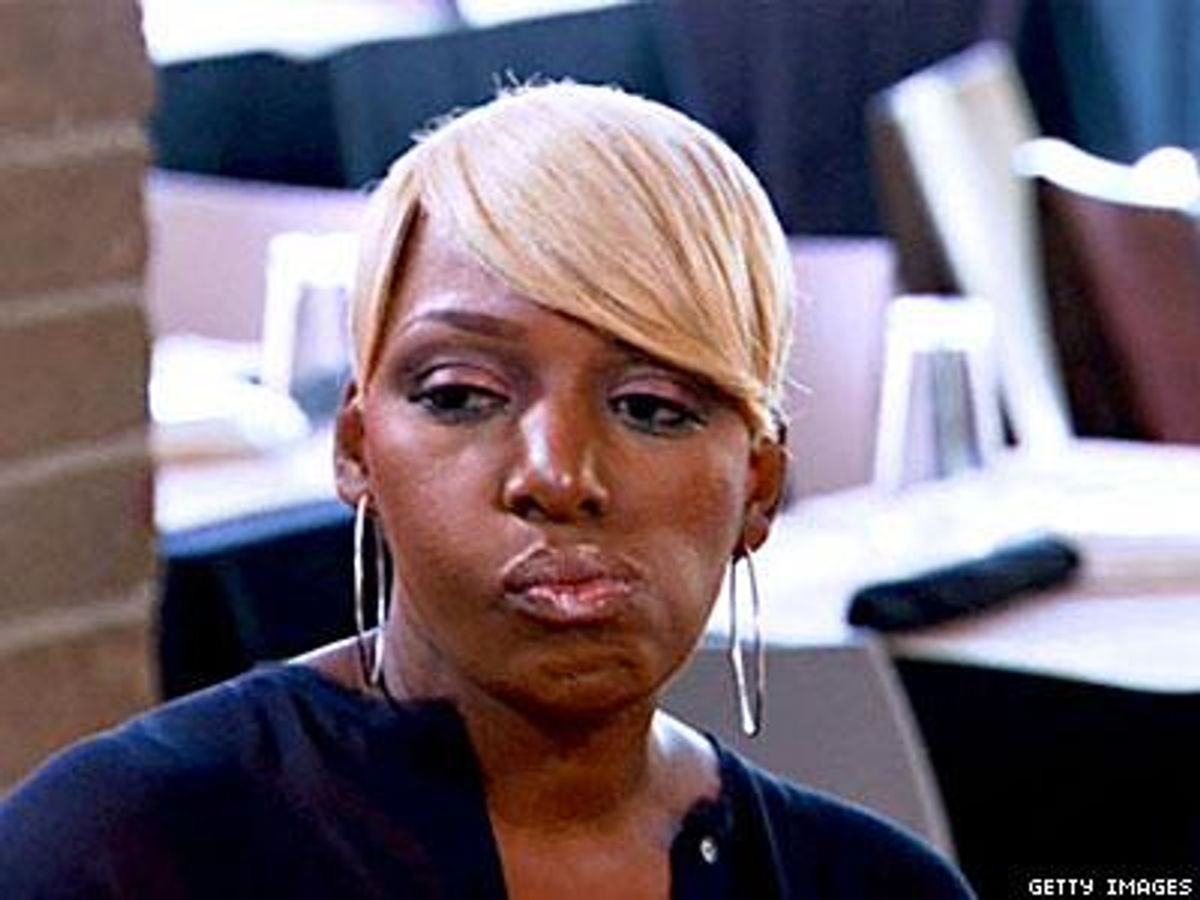

"I'm not trying to keep up with the Joneses I am the Joneses," proclaimed Nene Leakes. While she may have faked it until she made it, other "housewives" have filed bankruptcy or are heading in that direction. One could argue these women won the lottery by being cast on this show and possibly earning some pretty exorbitant salaries, but I wouldn't recommend trying to follow any of their financial advice.

Some Atlanta cast members were brazen enough to actually say they needed to fake it till they made it. This may be easier in Atlanta, where you may be able to rent a mansion for about the same amount as a dump in Beverly Hills or Manhattan. With two hit shows on TV and being the biggest star of the Real Housewives franchise, Leakes appears to have made it through faking it. But even she has faced quite a few financial messes, even after "cashing a [Donald] Trump check," as she stated.

Trending stories

Let's be real: I don't think we have any hidden "millionaire next door" types appearing on these shows. All of the women in the Real Housewives casts do quite a bit of faking it, from boobs and weaves to cars, houses, and so on. But how many of them really have wealth to back up their lifestyles?

Now, do you want to fake it or make it? Here is your guide to obtaining a lifestyle like a Real Housewives of Atlanta housewife:

Fake it, housing: Make sure to get a fabulous house that will make your friends jealous of you. Money is no object. Kenya Moore said she "can't live in less than 5,000 square feet." Moore said this in the same episode where she was evicted from her rented house! And who can forget Kim Zolciak being evicted from her rented house while putting on an over-the-top and probably extremely expensive wedding? Sheree Whitfield's home was sold in a foreclosure. The first time may have been due to her divorce from Pittsburgh Steeler Bob Whitfield, but Sheree had no one to blame but herself when her second house also fell into foreclosure. Remember, the house she wanted to build, with a ballroom, dubbed Chateau Sheree?

Make it, housing: Choose your housing wisely and don't overextend yourself. Purchasing real estate is a long-term investment, not just a status symbol. Who wants to be house poor or even worse, foreclosed on or evicted? Learn from any past mistakes to hopefully avoid repeating them. A good rule of thumb to consider is buying a house for less than four times your annual income.

Fake it, cars: If you want to look super fabulous, then rent a car for the day. Leasing a car for two or three years is a really big commitment, and that whole down payment thing can be really tough to produce. Did anyone else notice Whitfield driving a different car every time she was filmed? Does anyone really believe she owned five or six luxury cars? Perhaps it was possible if she wasn't paying her mortgage.

Likewise, don't get me started on the amount of times these ladies have reportedly had their automobiles repossessed. Really, your Bentley is being towed away? Is there anything less glamorous than that? Those Christian Louboutins are not made for distance walking.

Make it, cars: Owning is better than renting for the long term. If things go bad, how nice would it be not to have a car payment? And think of all the extra money you could put toward other financial goals without a monthly car payment. To be clear, leasing is just long-term renting. At the end of a lease you have nothing to show for your thousands in payments.

Fake it, debt: Shop till you drop, and if your cards aren't declined, keep shopping. When they start getting declined, it's time to consider bankruptcy. I imagine a lot of these families are facing crushing amounts of credit card debt. Keeping yourself in Louboutins, this season's high fashions, and handbags may cause financial pressure, and that's not even taking into account what many of these ladies pay for the over-the-top soirees, vacations, and plastic surgery seen on TV.

Make it, debt: Use debt wisely and when it makes sense. Avoid credit card debt at all costs because those sky-high interest rates will kill your financial future. It's not what you make but what you keep. If you never save anything, you will never be wealthy. It's as simple as that! Would you rather look like the Joneses and always be on the precipice of financial ruin, or would you rather be on track to being truly financially independent and on the road to wealth and happiness?

As for the self-proclaimed queen of the Joneses, Nene Leakes -- if she can keep her hot streak going, she will be fine. But all good things come to an end. How long can she make what she's making on Housewives (reportedly over $1 million dollars per year)? Glee is coming to an end after next year, and The New Normal, which provided her big breakout role,was canceled. It will be interesting to see what her future holds once the Housewives gravy train comes to a halt. Hopefully, she has some smart financial planners around her to prep for a rainy day.

You can probably guess I'm one of the millions tuning in each week to watch the ladies and all their drama. It can be great entertainment! And while their financial angst may literally be a million times bigger than anything you might be facing, you can still learn from their situations and hopefully avoid having to face something as terrible as an eviction, repossession or bankruptcy. We all want to be Gone With the Wind-fabulous, but I don't think any of us would want to trade bank accounts with Moore; however, I would like to try on that Miss USA tiara.

Feel free to share you favorite financial faux pas in the comments below.

DAVID RAE, CFP(r), has been helping members of the LGBT community plan for and enjoy retirement for over a decade. Follow him on Facebook on Twitter at @davidraecfp or via his website, DavidRaeFP.com.

Securities and advisory services offered through National Planning Corporation, member FINRA and SIPC, a Registered Investment Advisor. Trilogy and NPC are separate and unrelated entities.