Millions of Americans rely on credit to start businesses, pay for college, buy cars, or purchase homes. None of these borrowers should be denied a loan just because of who they are. Credit discrimination keeps worthy borrowers from tools they need to reach financial goals, and violates the fundamental American precept that we should all have equal access to opportunity.

But in America today there are two classes of borrowers: those whose equal opportunity to credit is federally guaranteed and those with virtually no protection at all. America's LGBT individuals are part of the second group.

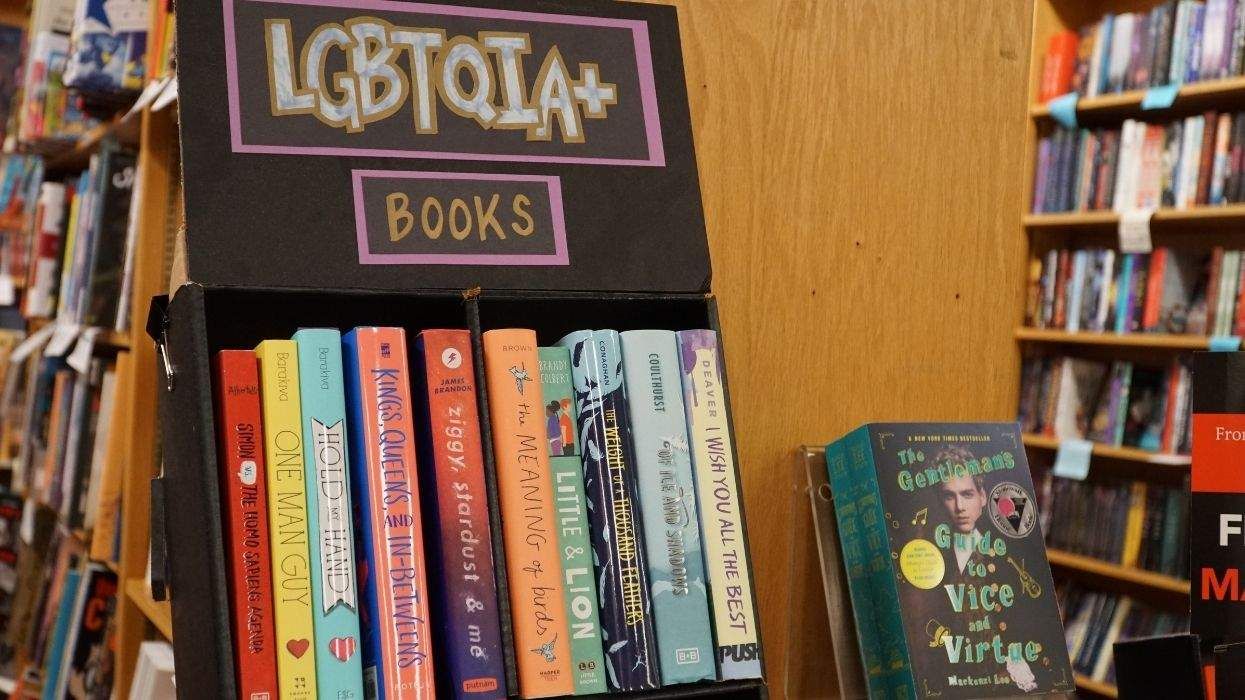

No federal law consistently protects LGBT borrowers from credit discrimination. The nation's primary law prohibiting credit discrimination, the Equal Credit Opportunity Act, prevents credit providers from discriminating against borrowers based on characteristics including race, color, religion, sex, and marital status. The ECOA, perhaps reflecting the homophobia rampant in 1974, excluded LGBT people. LGBT Americans rely on a tattered patchwork of state-based rules to protect themselves from discrimination. Only 10 states and the District of Columbia have enacted credit nondiscrimination laws covering sexual orientation and gender identity. Two additional states cover sexual orientation only.

No nationwide studies have quantified the incidence of credit discrimination against LGBT borrowers, so a full understanding of how pervasive the problem might be eludes us. But a recent poll found that 64 percent of LGBT Americans describe discrimination in their daily life as a major problem. It's not hard to conjecture that some have faced discrimination when seeking a loan. A recent report from the Center for American Progress is alarming to say the least, highlighting data that pairs of same-sex borrowers are denied mortgages at higher rates than different-sex pairs in which a man is the primary applicant.

While LGBT individuals may not have to disclose their orientation to creditors, why should they be forced back into the closet just to get a fair shot at securing a loan?

Let's also not forget that Big Data has created new potential and power to discriminate, irrespective of what a borrower willfully discloses to a creditor, and often times entirely unbeknownst to the borrower. Algorithms are becoming increasingly adept at parsing publicly available information to accurately predict everything from users' ethnicity to sexual orientation. In fact, according to Kate Crawford, a researcher at Microsoft, Facebook timelines, even when stripped of data like names, can determine a person's ethnicity with 95 percent accuracy, and sexual orientation is barely harder to pinpoint.

It may seem like the LGBT community has bigger battles to fight than credit discrimination. There's no question that efforts to secure the freedom to marry and employment nondiscrimination are battles worthy of LGBT people's grit and hustle. But the truth is that credit discrimination inflicts dire consequences on gay and trans Americans because credit is often essential to starting a business, financing a college education, and keeping affordable housing. Surely this is a battle worthy of our community's efforts.

A major step in the right direction is in the hands of lawmakers. Congress should pass a comprehensive bill banning discrimination based on sexual orientation and gender identity in credit, employment, housing, and federal funding. But absent this broad-based approach, lawmakers should get behind the Freedom From Credit Discrimination Act, which would amend ECOA to include sexual orientation and gender identity as federally protected characteristics.

The bill has been introduced in the House by Congressman Steve Israel three times, and Sen. Patty Murray of Washington introduced a version of it in the Senate in July 2013. Unfortunately, the bill has not been reintroduced in the 114th Congress. We urge members of Congress to reintroduce it or file a bill like it, and we urge the White House to issue a public statement of support to give the effort the attention it deserves.

They should take confidence from the fact that Americans overwhelmingly support equal opportunity. A recent poll found that 69 percent of Americans -- including 51 percent of Republicans -- want a federal law banning discrimination on the basis of sexual orientation and gender identity, including when seeking credit. This bill would send a powerful message to creditors. It would also empower federal agencies such as the Consumer Financial Protection Bureau to serve as cops on the beat, protecting LGBT borrowers from discrimination. And because you cannot assess progress on what you do not measure, the CFPB should start monitoring credit access for LGBT Americans. CFPB was given authority to collect data and track progress on credit access for protected classes under the Dodd-Frank financial reform law, but the agency has yet to implement data collection thus far.

Lenders should publicly declare support for amending ECOA and affirm today that regardless of what Washington does, they will voluntarily ensure equal credit access for LGBT borrowers who come to them for credit. Lenders should also invest greater resources in diversity training for credit officers to ensure all borrowers are treated with dignity and respect.

Creditors draw on myriad data points to determine a borrower's creditworthiness for a loan. Being gay should not be one of them.

BRAYDEN MCCARTHY is head of policy and advocacy at Fundera, an online marketplace that connects small businesses with financing. He was previously senior economic policy adviser in the Obama White House and Small Business Administration.

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes