All Rights reserved

By continuing to use our site, you agree to our Private Policy and Terms of Use.

We all know the stereotype of the typical gay man -- uber-successful, well-dressed fellows strolling around P-town, Fire Island and other glamorous haute spots. This pervasive image is double-edged, though, because it fails to acknowledge that just like any other demographic, the population of both gays and lesbians includes those toiling below the poverty line as well as those prospering at the highest echelons.

What interests me most are couples, however. To get an accurate view of the state of gay household finances, I headed over to a new report from the U.S. Department of the Treasury that provides a fairly accurate financial assessment of same-sex marrieds in the U.S.

I'm happy to announce that gay married men, making on average $176,000 per annum as a couple, clock in at 56 percent ahead of the income of our married straight counterparts. And really big winners of the income-earning contest are gay married couples with children who bring in a whopping $276,000 a year on average. (Of course, DINK -- double income, no kids -- gay couples lead the way in disposable income, of which, in my opinion, they're disposing way too much and not saving enough, but that's another story.)

Female couples aren't doing too poorly either, bringing in a household average of $124,000, which puts them financially ahead of the average straight married couple, who earn a yearly $113,000. Of course, nothing justifies the egregious gender pay gap that we'll also be exploring in more depth in the future.

So what gives? How do we explain the significant income disparities between married heterosexual couples and married same-sex couples? The Treasury Department's report offers some trenchant insights:

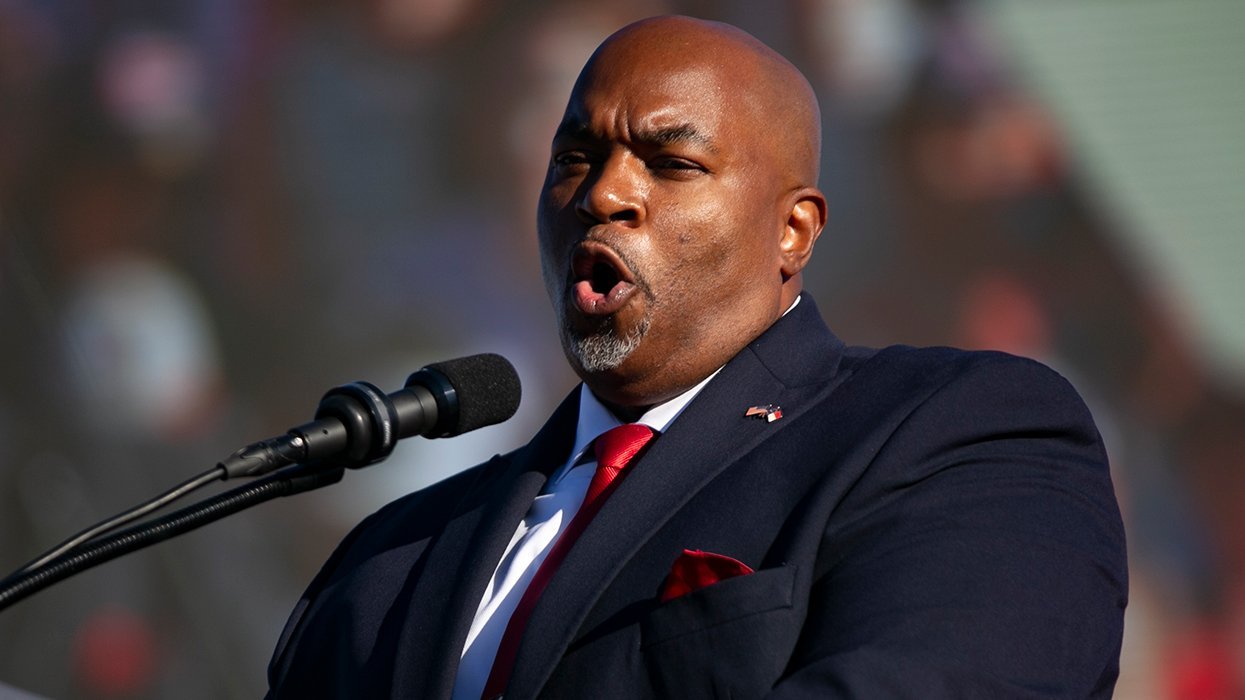

A large proportion of same-sex couples flock to major metropolitan areas -- sophisticated seats of power and centers of media, culture, and consumerism -- many of which are located on the coasts. These places tend to have higher cost of living but at the same time are the locus for jobs offering commensurate higher pay. Of course gay folks live everywhere but we are significantly better represented in what some would describe as more desirable cities that are, as it happens, the most gay-friendly as well. Would you rather live in Manhattan, L.A., Miami or San Francisco versus, say, the stomping grounds of Christian supremacist V.P.-elect Mike Pence in Indianapolis or homophobic Pat "The Great Discriminator" McCrory's Raleigh, N.C.? (No offense to the good people of Charlotte and other towns who worked so diligently to enact LGBT rights ordinances.)

Millennia of male privilege and entrenched economic sexism mean that men still make more than women do. Unfair, sure. Unexpected, not so much. It follows that two men make more than a male-female couple and certainly more than two women together. But here's the twist -- lesbian married couples on average actually earn more than their straight counterparts. Hmm.

It should be noted that heterosexual couples do in fact actually earn more than same-sex female couples when you compares couple who live in the same three-digit zip code regions. My guess is that lesbian couples earning more than the average straight couple has more to do with location than sexual orientation.

The Treasury Department report also states that same-sex female couples are four times more likely than their married gay male peers to have children. The study doesn't differentiate between the lives of lesbian mothers who have had children through prior heterosexual conjugation versus those handling procreation with their female spouse.

Gay married men with children bring in the biggest bucks of all, as I noted above -- a good thing, because without a very understanding, supportive, and fertile female friend they're going to need them. Victims of a perfect storm of physiology, bureaucracy, and prejudice, gay male marrieds need to jump through the most hoops and shell out the greatest expense to add a child to their family (unless they go through the arduous process of foster adoption). Private adoption can easily run $30,000 or more (where it is even possible) and that pales in comparison the cost of a surrogate, which can run up to $250,000 or more.

Marriage statistics are not easily tracked at the federal level. So truly assessing the lives and pocketbooks of same-sex couples can be quite a challenge. Homophobia is alive and well, and many people don't always out themselves to census workers or on other surveys. However, the one place where people do reveal their orientation is when filing taxes as part of a couple. (It's a pretty safe assumption that if you're in a same-sex marriage you are indeed gay or bisexual.)

The Treasury Department study is based on the tax returns of same-sex couples filing jointly in 2014, which gives us the most accurate picture of same-sex marriages to date. (Side note, 2014 is the year I married my handsome husband, Ryne, and we filed jointly for the first time with our 2014 tax returns.) In 2014 there were 183,280 same-sex married couples in the USA, which breaks down to roughly one third of one percent (that's roughly 1 300th) of all marriages. The actual number of same-sex couples may be a tad higher, as not all of them file jointly, though it's been estimated that something around 97.5 percent of married couples do file joint returns. Regardless, the number of same-sex marrieds filing jointly will inevitably rise.

My previous post, "How Love and Marriage will change LGBT Retirement," emphasizes that having the legal right to wed will improve the financial well-being of the LGBT community as a whole.

Though the Treasury Department report shows that many same-sex married couples are doing well on the income side, it has yet to be determined how we are doing on the wealth-building side. Remember, it's not so much about what you make that is important but rather what you keep, save, and invest that will build your nest egg.

Whether you are at an advantage or disadvantage financially, you'll want be proactive and take steps to reach your various financial goals for yourself and your family. No matter who you are or what your sexual orientation, without hard work and strategic financial planning you will have a tough time reaching financial independence.

Congratulations to all people who are spending their lives with someone they love. Though we're still woefully behind on transgender financial parity, the LGBT community is moving forward and making significant progress. No longer relegated to second-class citizen status, you and your significant other can at last enjoy the thousand-plus benefits that the government bestows on the legally married of every stripe.

Until next time and as always be fiscally fabulous. Gay money matters!

DAVID RAE, Certified Financial Planner(tm), Accredit Investment Fiduciary(tm) is a Los Angeles-based retirement planner with Trilogy Financial Services. He has been helping the LGBT community and friends reach their financial goals for over a decade. He is regular contributor to the Investopedia and The Huffington Post and author of the FinancialPlannerLA.com blog. He lives in Los Angeles with his husband, Ryne, and their two Chihuahuas. Follow him on Facebook,\ or via his website, www.davidraefp.com.

Viral post saying Republicans 'have two daddies now' has MAGA hot and bothered