While New York Rep. George Santos is fighting calls from some of his colleagues and constituents to resign from Congress, his first bill in the House addresses a potentially very popular issue on New York's Long Island: state and local tax (SALT) deductions.

The congressman, known for falsifying his resume, education, religion, and family histories, introduced legislation on Tuesday to increase the SALT deduction to $50,000.

"Long Island residents specifically in Nassau County are paying some of the highest property taxes in the country," Santos said in a press release announcing his bill.

He wrote that in 2018, Nassau County residents reported paying more than $30,000 in state and local tax liability, but because of the $10,000 cap, the average deduction was just over $9,000.

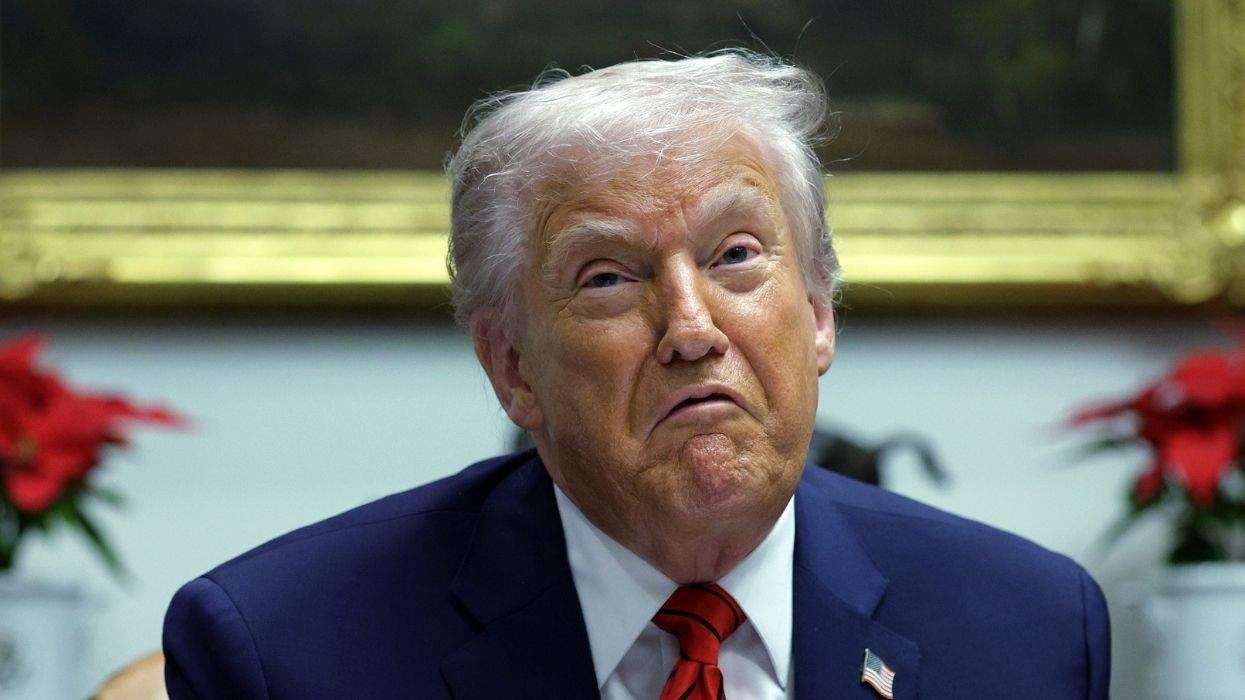

In former President Donald Trump's 2017 tax giveaway to mostly wealthy Americans and corporations, the SALT write-off was capped at $10,000, something residents in states with higher taxes have been critical of for a long time.

"I am proud to introduce legislation that increases the limitation on the deduction of SALT," Santos said. "While the cost-of-living continues to plague New Yorkers, and by raising the cap on SALT will provide real tax relief not just to New York's Third Congressional District but to all."

Some Democratic House members who in 2022 had threatened to vote against President Joe Biden's taxes and climate plan unless it increased state and local tax deductions now indicate they'll vote for it, Bloomberg reports.

SALT deductions reduce the cost of state and local taxes for taxpayers because the federal government effectively pays for a portion of those taxes.

SALT caps reduce the value of deductions, increasing the cost to taxpayers. In addition, state and local tax and spending behavior may be affected, as any reduction in state and local revenues resulting from increased sensitivity to SALT-eligible tax rates must be offset by cuts in outlays or increases in other income for budgetary purposes.

Under the SALT cap, state and local tax policies influence how the SALT deduction is valued.

Santos spoke about the bill on the House Floor with one minute granted for his remarks.

"Increasing the SALT deduction is a step in the right direction to lessen the burden of combined Federal, State, and local taxes during these times of economic hardship," the gay Republican said.

"New York has one of the highest tax rates in the country, ranking above—including Federal, State, and local taxes. Let it be known that the SALT tax is not a tax break for the wealthy but a tax relief for working-class families," Santos continued. "This is about the 118th Congress working to ease the affordability burden in high-tax States like New York."

"The cost of living continues to plague New Yorkers [and] raising the cap on SALT will provide real tax relief, not just to New York's Third Congressional District but to all in America," Santos said.

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes