Carl Bechdel and Dan Miller started looking for a family plan on the Pennsylvania health insurance marketplace last fall. After submitting their application for a bronze-level plan to Highmark Blue Shield in early December, they became concerned when the end of the month approached and they hadn't heard from the insurer. Bechdel called customer service and finally learned the reason: The company doesn't offer family coverage to same-sex couples.

The Highmark employee explained that the company would sell each of them an individual policy and that their costs would be no different than if they bought a family plan. But that was small comfort for the Harrisburg couple, who were married in the District of Columbia in 2012.

"It's really the disrespect of being treated differently," says Bechdel, 60.

Despite the Justice Department announcement on Monday giving same-sex married couples equal recognition in federal courthouses, prisons and other DOJ programs, inconsistency in the treatment of same-sex married couples under the health law remains, leading to confusion and dismay in some cases, experts say. On the one hand, federal rules say that legally married same-sex couples should be treated the same as opposite-sex couples when it comes to determining eligibility for premium tax credits and cost-sharing subsidies that reduce the cost of marketplace plans. That guidance was released last fall after the Supreme Court struck down a key section of the federal Defense of Marriage Act, which defined marriage as being between members of the opposite sex.

But when it comes to defining "family" for health insurance purposes, there's no clear federal definition; the decision is left up to the states. Moreover, if state law doesn't spell out what "family" or "spouse" means for insurance purposes, insurers generally have flexibility to make those determinations themselves.

"CMS is aware that same-sex married couples in some states are experiencing issues in obtaining family plans and is looking into ways to address this issue for the 2015 plan year," says Aaron Albright, a spokesperson for the Centers for Medicare & Medicaid Services.

If a married couple buys two individual policies rather than a family plan on the state marketplace, neither their premium nor subsidy amounts should be negatively affected, say experts. The family premium would be the sum of the two individual premiums, and the subsidy amounts would be divvied up between the two plans.

Same-sex married couples who live in one of the 16 states or the District of Columbia that recognize same-sex marriages shouldn't have trouble buying a family plan, say experts.

Highmark, which offers plans in West Virginia, Delaware and Pennsylvania, determines whether to offer same-sex married couples family plans based on state same-sex marriage laws, said Kristin Ash, a spokeswoman for the company, in an email. Couples who live in Delaware, where same-sex marriage is recognized, can buy a single family policy, while couples in the other two states, where such marriages are not recognized, can't. Ash says the company is evaluating this policy for future plans.

Blue Cross Blue Shield of North Carolina has already done so. The company had initially planned to postpone offering family coverage to domestic partners and same-sex married couples until 2015 while it dealt with technology requirements related to the health law.

But after the local press, advocates and couples whose insurance had been cancelled drew attention to the insurer's stance, Brad Wilson, the company's CEO, announced in January that Blue Cross Blue Shield Of North Carolina worked with CMS and the state department of insurance to make family coverage available to same-sex married couples and domestic partners in the individual and small group markets this year.

"We should have more thoughtfully considered this decision, with full appreciation of the impact it would have on same-sex married couples and domestic partners," said Wilson in his statement. "We're sorry we failed to do so."

Thomas Hafke, and Chad Higby are pleased with the outcome. The Aberdeen, N.C., couple was married in the District of Columbia in 2012. They were notified by BCBSNC that their silver-level plan was cancelled shortly after they bought it.

"If there was another company I could go with I would have, but there's no other option in our county," says Hafke, 29. "Them calling and apologizing helped a little bit."

Some experts say the lack of a clear definition of family for coverage purposes in the law is troubling. After all, they point out, the health law explicitly prohibits discrimination based on sexual orientation or gender identity.

"At what point does it become discrimination?" asks Katie Keith, director of research at the Trimpa Group, a consulting group that works with lesbian, gay, bisexual and transgender advocacy organizations. "Now you have these health plans saying that heterosexual couples can be married and get family plans but that same-sex married couples can't."

KAISER HEALTH NEWS (KHN) is a national health policy news service. It is an editorially independent program of the Henry J. Kaiser Family Foundation.

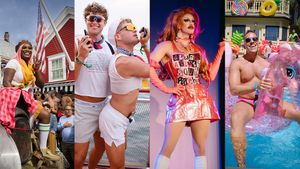

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes