A landmark bill

enabling California's registered domestic partners to

file joint state income tax returns and have their earned

income treated as community property for state tax

purposes was signed by Gov. Arnold Schwarzenegger

on Saturday. The State Income Tax Equity Act was

sponsored by Equality California and authored by lesbian

state senator Carole Migden of San Francisco.

"This is a

historic day for equality," Migden said in a

statement. "The governor's signature on my tax equity bill

gives lesbian, gay, bisexual, and transgender

families, who share the same costs and

responsibilities that go with parenthood or being a spouse,

the same tax benefits afforded to married

couples. At last we acknowledge the equal

contributions of LGBT households and remove the tax

inequity that has been suffered by these families."

An average family

of four with one stay-at-home parent could save as much

as $2,000 a year by filing jointly.

In related news,

Schwarzenegger also signed the Equality in Prevention

and Services for Domestic Abuse Fund, which establishes a

fee on domestic-partnership registrations to support

education and services for lesbian, gay, bisexual, and

transgender victims of domestic violence. "Enactment

of this bill means that all victims of domestic

violence--regardless of sexual orientation or gender

identity--will receive basic information and

services," Geoff Kors, executive director for the gay

rights group Equality California, said in a statement. "We

applaud the governor for signing this bill into law."

(The Advocate)

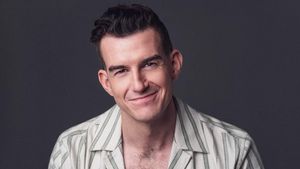

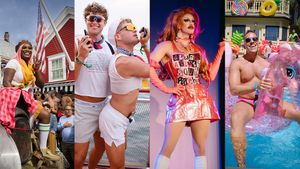

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes