In the March 29, 2005, issue in the sidebar to the article "Debts & Taxes: Gains in Good Conscience," you state that where one partner in a couple earns substantially more than the other, "it makes sense to 'gift' a portion of their income" to the other. "This way, the tax liability is lower for the higher income earner." You also stated that under the Internal Revenue Code "there is an $11,000 limit on gifts to individuals, creating a major opportunity to reduce your tax bill."The author, Mike Hudson, has unfortunately confused an income tax deduction and a gift tax exemption.My partner, Will Perras, an H&R Block preparer, noticed this glaring error. There is no provision, nor has there ever been, under the IRS Code for a deduction from one's income for gifts to individuals. Gifts to charitable institutions--organizations qualifying under 501(c)(3) of the Code--are deductible on Schedule A of Form 1040, but gifts to individuals or organizations that have not applied for and obtained 501(c)(3) status are not deductible. While making a gift to a partner may be exempt from the federal gift tax, it has absolutely no effect on the donor's income tax.The Code does allow for an exemption from the estate and gift tax of up to $11,000 each year for gifts to as many different individuals as the donor can afford. In addition, everyone has an estate and gift tax credit which currently offsets lifetime gifts of up to $1 million over and above the total $11,000 exempt gifts. This does create a tax-shelter planning opportunity for unmarried couples, both gay and straight. The partner with a high net worth can give up to $1 million of their assets with no gift tax liability to the partner with a lower net worth. After this gift is completed, the future income on the gifted amount will be income taxable to the partner with lower net worth who was presumably in a lower income tax bracket, thereby creating an income tax savings.In addition, this technique of estate splitting can also avoid federal estate taxes, since the assets given to the partner with lower net worth will not be subject to the estate tax at death--assuming his or her estate is valued at less than $1.5 million under current law.We also thought that the item "Use U.S. savings bonds to earn tax-free income" was misleading. Interest earned on U.S. Treasury Series E, EE, and I bonds is not subject to federal income tax until the bonds are cashed in, but at that time the accrued interest is subject to federal income tax. And for people who are cashing in a large number of bonds at one time, this increase in income may push them into a higher bracket.The Treasury does offer Series H bonds which pay interest semi-annually; you get the interest and pay the income tax as you go. Interest earned on all U.S. government bonds is exempt from state and local income tax.Harold L. Harkins Jr.Attorney at LawTampa, Fla.

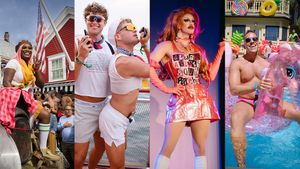

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes