CONTACTStaffCAREER OPPORTUNITIESADVERTISE WITH USPRIVACY POLICYPRIVACY PREFERENCESTERMS OF USELEGAL NOTICE

© 2024 Pride Publishing Inc.

All Rights reserved

All Rights reserved

By continuing to use our site, you agree to our Private Policy and Terms of Use.

George Kresslein just celebrated his 50th birthday, an especially meaningful milestone for the Virginia accountant since he never thought he'd live that long: Fourteen years ago he was diagnosed with HIV infection, when such news was considered a death sentence.

But having survived the disease thus far, Kresslein has a new worry: planning for retirement. "The reality is, I never thought I would reach retirement, so I did not save for it," he says. "In fact, I cashed in my life insurance and pulled money from my retirement plans."

Kresslein is like many clients we see: HIV-positive men who are stressing out over golden years they never thought they'd see. But even if you never planned for retirement, getting on track is not that difficult. The basic actions are the same for anyone who hasn't seriously thought about his or her financial future:

* Benchmark your current financial position.

* Maximize contributions to retirement plans.

* Reduce your future expenses (by, say, downsizing to a smaller home).

* Eliminate credit-card debt.

* And consider a postretirement job.

The main thing to do differently is to take advantage of any long-term care insurance offered by your employer, since people with HIV aren't eligible for a private policy. Some companies offer group policies that may not require medical underwriting, though, so check with your benefits department. Although you might have to wait until an open-enrollment period to qualify, it's worth the wait to make sure you're taken care of--if and when you can no longer take care of yourself.

From our Sponsors

Most Popular

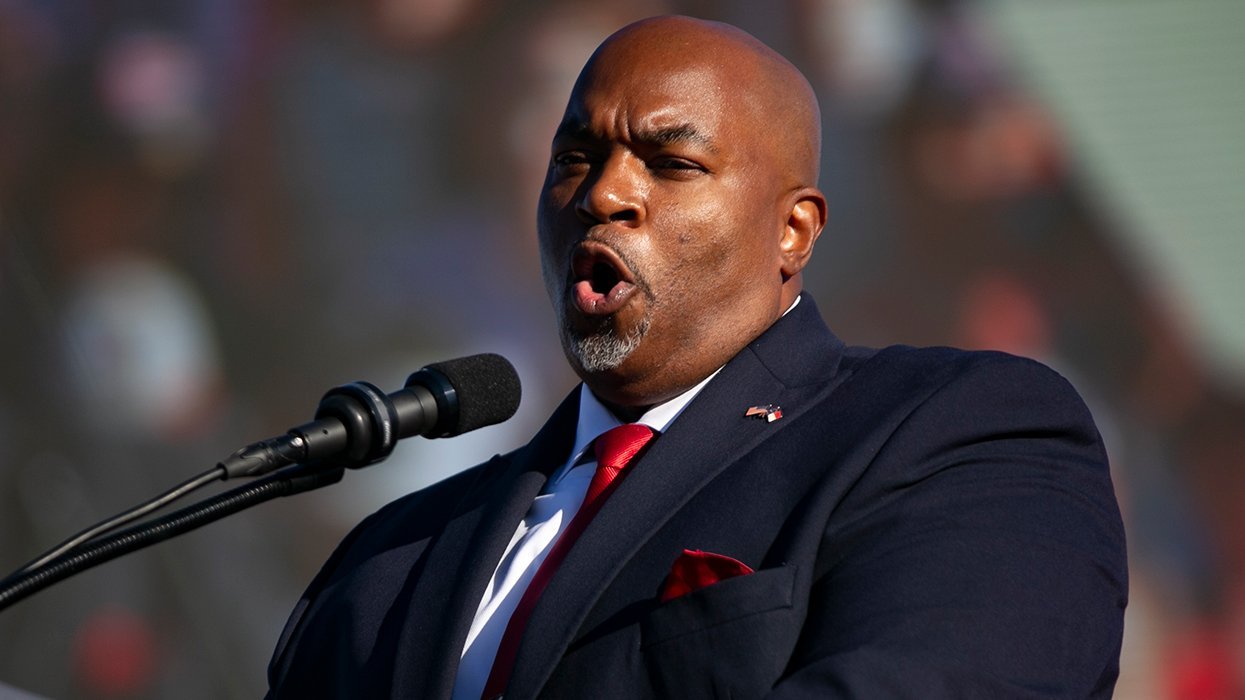

18 of the most batsh*t things N.C. Republican governor candidate Mark Robinson has said

October 30 2024 11:06 AM

True

After 20 years, and after tonight, Obama will no longer be the Democrats' top star

August 20 2024 12:28 PM

Trump ally Laura Loomer goes after Lindsey Graham: ‘We all know you’re gay’

September 13 2024 2:28 PM

60 wild photos from Folsom Street East that prove New York City knows how to play

June 21 2024 12:25 PM

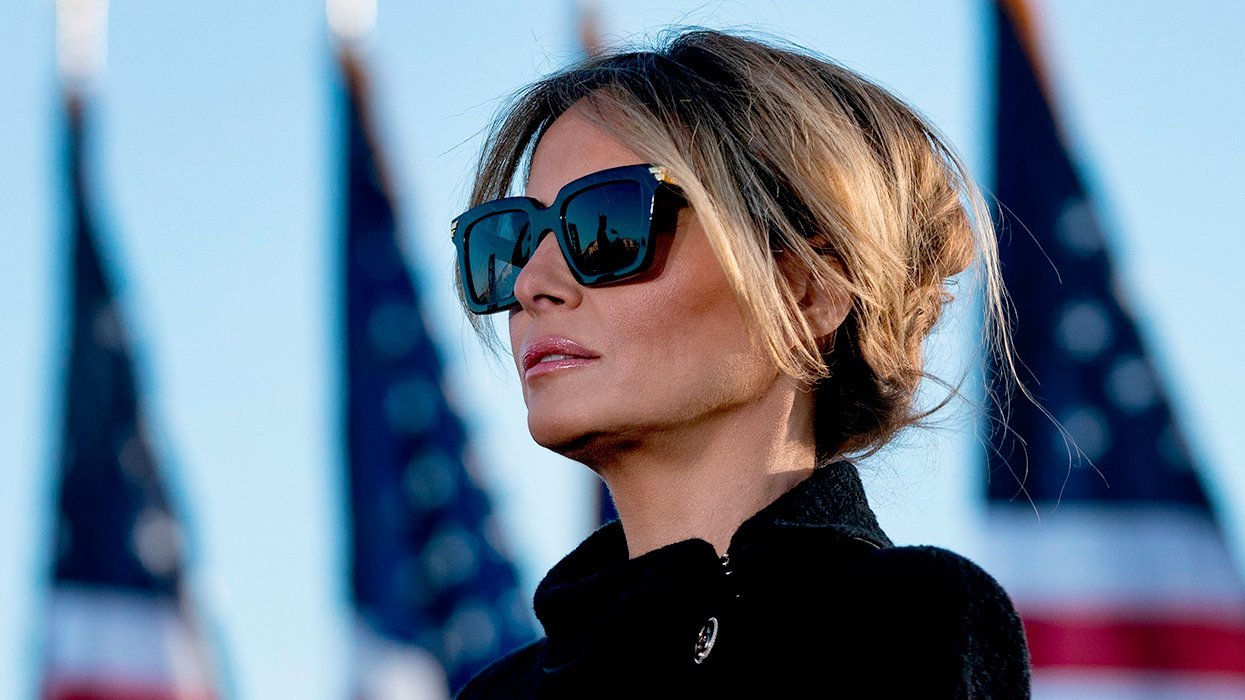

Melania Trump cashed six-figure check to speak to gay Republicans at Mar-a-Lago

August 16 2024 5:57 PM

If you think Project 2025 is scary, take a look at Donald Trump's Agenda 47

July 09 2024 2:35 PM

Latest Stories

What’s happening with Nancy Mace’s anti-transgender bathroom bans?

November 21 2024 6:14 PM

All the Trump presidential nominees who've been accused of sexual misconduct

November 21 2024 5:34 PM

Former Obama White House Counsel explains what could happen to Trump’s Cabinet nominations

November 21 2024 4:43 PM

Nancy Mace supported an LGBTQ+ equality bill before pushing a transgender bathroom ban

November 21 2024 4:08 PM

Ex-marine who allegedly tore down tattoo shop's Pride flag charged with hate crime

November 21 2024 3:35 PM

'A betrayal': Trans people respond to Sarah McBride's bathroom ban compliance

November 21 2024 12:36 PM