The U.S. Commerce Department released its monthly report Monday, indicating that retail sales experienced a modest increase of 0.2 percent in February, following a revised 1.2 percent decline in January. This subdued growth has retailers pushing the panic button, forcing them to reassess their strategies in anticipation of potential economic challenges.

Keep up with the latest in LGBTQ+ news and politics. Sign up for The Advocate's email newsletter.

Before I came full time to The Advocate two years ago, I spent over 30 years in public relations, with a good chunk of that time helping to lead PR/media relations for Toys “R” Us, Sears, Kmart and Macy’s. In addition, working for agencies, I worked with other retailers such as what was then Dunkin’ Donuts and Godiva. I saw firsthand what happens when numbers like stock prices and consumer spending start to sink.

I can tell you one thing, and that is internally at retailers across the country, there is a lot of hand-wringing going on right now. Anyone who has worked in corporate PR knows that when sales slump, marketing budgets get slashed — usually first — and many PR teams are under the marketing purview, and PR budgets and employees are usually one of the first areas to be cut.

Facing all these external pressures, retailers usually implement several internal measures to safeguard their financial stability. These include reassessing product offerings to focus on high-margin or essential items, reducing workforce numbers to control labor costs, and cutting budgets in areas like corporate philanthropy and marketing dollars.

I have seen firsthand how these reductions play out, and they can be severe. There’s a scaling back on advertising expenditures, limiting of promotional campaigns, and decreasing investments in brand-building initiatives. I’ve seen C-level folks roll their eyes whenever I’ve mentioned the term “brand awareness” in relation to pitching more money for a PR campaign.

During economic downturns, the McKinsey Report estimated that companies may cut marketing expenditures by 8 percent to 20 percent, with some large public companies reducing their marketing budgets by more than 20 percent.

However, those of us in marketing departments argued, and most of the time unsuccessfully, that such budget cuts can be counterproductive. Reducing marketing efforts during periods of slower sales can lead to decreased brand visibility (that’s a more accepted word than “awareness”) and weakened customer engagement, potentially exacerbating the decline in sales.

Marketing folks always push for maintaining or even increasing marketing investments during challenging times since they can help sustain customer interest and loyalty, positioning the brand for a stronger recovery when economic conditions improve. But few retailers focus on the long term. Everything is about today, now, immediately, and less about tomorrow. And if it's a public company, obsession over shareholder value. And saying to the powers that be that marketing spending should remain consistent for future progress falls on deaf ears.

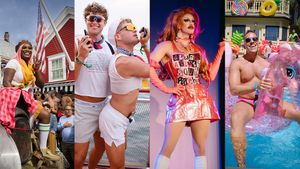

And I have a warning for all those who complained about “pinkwashing” around Pride Month in recent years. This year, retailers are not only looking at bleak sales reports, they are also contending with walking a fine line regarding their diversity, equity, and inclusion programs. Many, like Target, have just cut them in response to the Trump administration ridding them throughout the federal government. Suddenly, DEI has become a four-letter word.

If DEI programs haven’t been cut yet, poor sales figures will surely mean that they’ll be cut soon, since the Trump administration has targeted and tarnished DEI programs. That could mean less expenditure and less involvement around Pride initiatives this year. And there’s plenty of bellwethers for that scenario.

Five corporate sponsors have already pulled out of San Francisco Pride, and sponsors are already pulling out of WorldPride in D.C. this summer. This has all happened before the sluggish sales report today, so the worst might yet come.

Compounding the challenges posed by sluggish sales are Donald Trump's fluctuating tariff strategies, which have introduced additional uncertainties for retailers. The imposition of tariffs on imports from major trade partners, such as China, has led to increased production costs for many businesses.

If you go shopping at a big-box retailer and pick up almost any item that isn’t food, you’re likely to see that “made in China” tag. It’s ubiquitous. This escalation in costs of China-made products often — OK, always — results in higher prices for consumers, potentially dampening demand and further straining retailers' profit margins.

This means that consumers will be paying more. It’s a vicious cycle, because even if consumers hear or read on the news they’ll be paying more, they’ll stop shopping. And on top of it all is the talk of a recession scaring the bejesus out of Wall Street and Main Street. Basically, if you’re a retailer, you’re screwed.

It’s a perfect storm of slower sales, threats of price increases, tariffs, stock prices sliding, and shoppers staying away and spending less that spells big trouble for retailers.

Similarly, I remember what happened in the late 2000s when I was in the thick of it all during the financial crisis. It was doom and gloom. And I think that’s when the “value,” so to speak of big-box retailers, like the ones I worked with started to slide. That’s what happened to Toys “R” Us, Sears and Kmart, which all went (mostly) out of business eventually. They started with staff cuts, budget cuts, closing stores until it all whirled down into the proverbial toilet.

Several prominent retailers have already announced significant store closures or financial difficulties. Forever 21, a well-known fast-fashion retailer, has filed for bankruptcy for the second time in six years and plans to close all its U.S. stores, totaling approximately 350 locations. The company cited increased competition from online retailers and declining mall traffic as primary factors contributing to its financial distress.

Dollar General has announced plans to close 96 stores in early 2025, along with 45 locations under its PopShelf brand. Additionally, Macy's Inc. has confirmed the closure of 66 store locations as part of its "Bold New Chapter" strategy. This plan aims to return the company to sustainable, profitable sales growth by closing underperforming stores Furthermore, Kohl's has announced plans to close 27 stores across the U.S. in 2025, reflecting ongoing challenges in the retail sector.

For the average consumer, these industry adjustments could lead to a reduced variety of products, diminished customer service quality due to workforce cuts, and decreased support for community programs previously funded by corporate philanthropy. These changes may collectively contribute to a less vibrant and supportive consumer environment.

And if you’re a PR flack, like I was, you’re not only worrying about your job, but you’re also worrying about what the doom and gloom means for how the media is portraying your brand. Trust me, working for a retailer when the numbers are grim is worse than cleaning up a mess in aisle 3.

Voices is dedicated to featuring a wide range of inspiring personal stories and impactful opinions from the LGBTQ+ community and its allies. Visit Advocate.com/submit to learn more about submission guidelines. Views expressed in Voices stories are those of the guest writers, columnists, and editors, and do not directly represent the views of The Advocate or our parent company, equalpride.

Charlie Kirk DID say stoning gay people was the 'perfect law' — and these other heinous quotes